Exploring Opportunity Funds: Investing in Economic Development and Tax Benefits

In today’s dynamic financial landscape, investors are continually seeking opportunities that offer not only financial growth but also avenues to contribute positively to their communities. Opportunity Funds have emerged as a powerful investment option, aligning financial growth with the prospect of contributing to economic development while enjoying significant tax benefits. This article delves into the world of Opportunity Funds, examining what they are, their potential benefits, and how you can get started with this innovative investment approach. Exploring Opportunity Funds .

Table of Contents

- Understanding Opportunity Funds

- The Genesis of Opportunity Zones

- Investing in Economic Development

- Tax Incentives: A Game Changer

- Eligibility and Investment Requirements

- Setting Up an Opportunity Fund

- Choosing the Right Project

- Due Diligence in Opportunity Fund Investments

- The Long-term Perspective

- Impact on Communities

- Real-Life Success Stories

- Risks and Challenges

- Diversifying Your Investment Portfolio

- Tax Implications and Reporting

- Exploring Future Trends

Understanding Opportunity Funds

Opportunity Funds are investment vehicles designed to stimulate economic development in underserved communities. These funds provide a unique opportunity for investors to funnel capital into designated Opportunity Zones, thereby promoting local businesses, infrastructure, and housing developments.

The Genesis of Opportunity Zones

The Opportunity Zone program was established under the Tax Cuts and Jobs Act of 2017. It identified economically distressed areas and encouraged private investment through tax incentives. This initiative aims to revitalize struggling communities by attracting investors and fostering long-term growth.

Investing in Economic Development

One of the primary goals of Opportunity Funds is to invest in projects that drive economic development. These projects may include commercial real estate, affordable housing, startups, and infrastructure improvements. Investing in such projects not only benefits the investors but also the communities where these opportunities are located.

Tax Incentives: A Game Changer

The most compelling aspect of Opportunity Funds is the generous tax benefits they offer. Investors can defer capital gains taxes by investing in these funds, and if held for a specific period, they can even eliminate a significant portion of the tax liability.

Eligibility and Investment Requirements

To take advantage of these tax incentives, investors must meet specific eligibility criteria and invest in qualified Opportunity Funds. Understanding these requirements is crucial to making informed investment decisions.

Setting Up an Opportunity Fund

If you are considering establishing your Opportunity Fund, it’s essential to comprehend the steps involved in its creation, management, and compliance with IRS regulations.

Choosing the Right Project

Selecting the right project within an Opportunity Zone is critical. Investors should conduct thorough research, including due diligence, to ensure the success of their investments.

Due Diligence in Opportunity Fund Investments

Performing due diligence is paramount. Evaluating the potential risks and returns associated with a project is crucial to making well-informed investment choices.

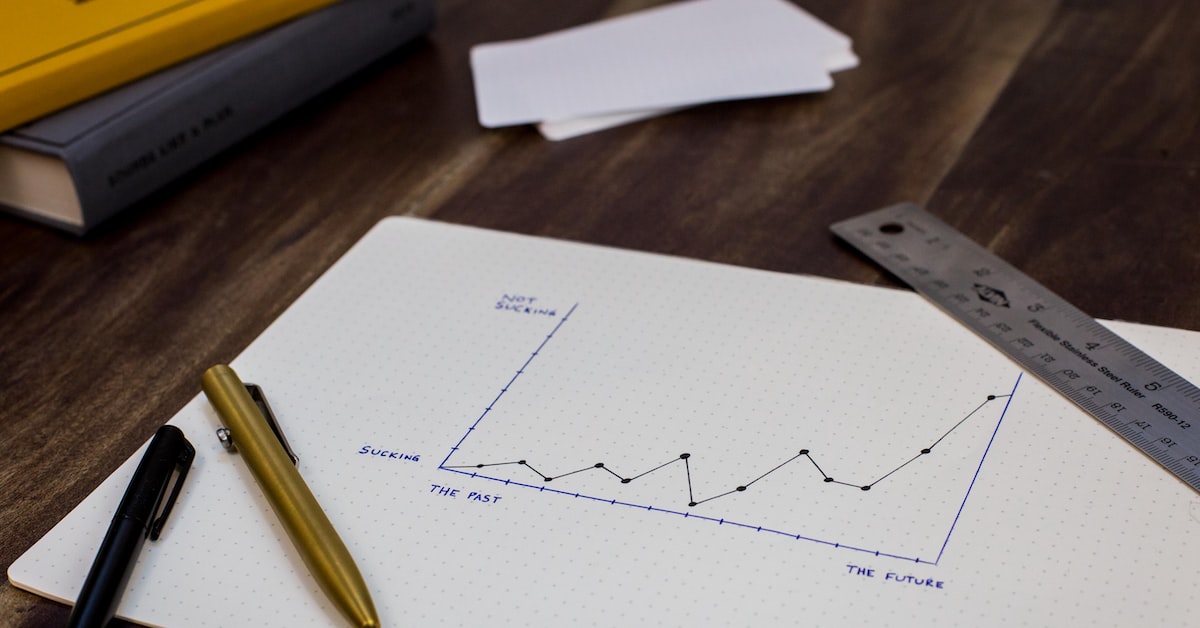

The Long-term Perspective

Opportunity Fund investments often have a long-term horizon. Understanding the implications of a long-term commitment is vital for investors seeking to maximize their tax benefits.

Impact on Communities

Investments in Opportunity Zones can significantly impact the communities they serve, creating jobs, improving infrastructure, and fostering sustainable economic growth.

Real-Life Success Stories

To better appreciate the potential of Opportunity Funds, it’s instructive to explore real-life success stories and see how they’ve positively affected both investors and communities.

Risks and Challenges

While the benefits of Opportunity Funds are enticing, investors should be aware of potential risks and challenges that come with these investments.

Diversifying Your Investment Portfolio

Diversification is a key strategy in any investment portfolio. Opportunity Funds can be a unique addition, offering both financial growth and community impact.

Tax Implications and Reporting

Understanding the tax implications and reporting requirements associated with Opportunity Funds is crucial to ensuring compliance and maximizing tax benefits.

Exploring Future Trends

Opportunity Funds continue to evolve. Staying updated on the latest trends and developments in this field can help investors make informed decisions and seize new opportunities.

Opportunity Funds present a win-win situation for investors and underserved communities. By investing in projects that promote economic development and taking advantage of significant tax incentives, you can not only grow your wealth but also contribute to the betterment of society. As you explore this investment avenue, keep in mind the risks, challenges, and compliance requirements to make the most of this opportunity.

FAQs

1. What are Opportunity Zones?

Opportunity Zones are economically distressed areas designated for investment under the Opportunity Zone program. Investors in these zones can enjoy tax benefits while stimulating local economic development.

2. How can I invest in Opportunity Funds?

Investing in Opportunity Funds involves selecting a qualified fund and adhering to IRS regulations. It’s advisable to consult with a financial advisor to ensure compliance.

3. What is the minimum investment required for an Opportunity Fund?

The minimum investment requirement can vary between Opportunity Funds. It’s essential to check the specific fund’s requirements before investing.

4. What are the tax benefits of Opportunity Funds?

Investors can defer and reduce capital gains taxes by investing in Opportunity Funds and holding their investments for specified periods.

5. Are Opportunity Fund investments suitable for all investors?

Opportunity Fund investments may be suitable for those looking for long-term investments and who are willing to contribute to community development. However, it’s essential to evaluate your specific financial goals and risk tolerance before investing.

You may also like this : The Impact of Global Supply Chain Disruptions on Investments: Navigating Shocks